Value of Irish foodservice industry increases but cost-of-living crisis impacting consumers – Bord Bia report

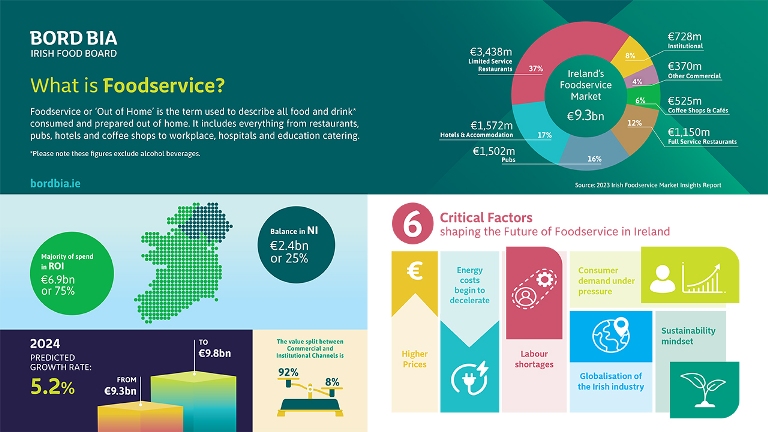

Findings from Bord Bia’s annual Foodservice Market Insights report show that the Irish ‘out of home’ sector was up nearly 13% this year to a new record high of €9.3 billion across both the Republic of Ireland and Northern Ireland. This is the first time that the market value has exceeded pre-pandemic levels, and this growth has been achieved amidst a surge of challenges over the last four years, although industry growth has slowed from the significant increases seen in 2022. Forecasts for 2024 indicate that a rebalancing of consumer demand following a post-pandemic surge, along with increasing economic uncertainty, will result in a more discerning occasion-led approach to dining out of home.

Feeling the pinch

The report contains findings from consumer research conducted in Ireland, UK and Germany in relation to consumer attitudes to eating out of home. Consumers from all three countries have noticed that eating out is becoming more expensive, with the majority surveyed in Ireland (86%) and the UK (78%) believing dining out has become too expensive to do on a regular basis.

The report uncovered a number of emerging trends in foodservice including:

- Higher prices: The industry has been struggling with cost inflation driven by cost of goods and other input prices which have been passed on to the consumer. In order to justify these price increases consumers expect consistent value and quality.

- Sustainable mindset: For commercial foodservice operators, sustainability is still top of mind, but linked more to cost control, such as energy-related initiatives. For those in the contract catering or ‘business feeders’ sector, sustainability is more advanced in general, with operators investing in things like food waste, use of upcycled materials and local food. In the current climate, sustainability was not found to be a motivating factor for consumers when choosing where to eat out, or what to eat.

- Eating out less often: Consumers are cutting out spontaneous dining, in favour of other activities and choosing to eat out for special occasions like birthdays and reunions. Treating oneself and spending time with family, along with convenience and speed when not wanting to cook at home are also cited as reasons to eat out.

- Menu choice considered: Consumers are cutting back on alcohol, not ordering secondary courses or choosing to split starters or desserts. There has also been an increase in choosing less expensive and smaller dishes to keep to a budget.

- Venues with value: Venue choice is more considered than before as dining out is becoming less frequent. When selecting where to eat, value for money is a main motivator for consumers.

- Mixed reactions to Technology: While technology has enhanced efficiencies and speed in foodservice, some consumers are stating preference for less technology such as non-digital menus in favour of a more personal approach.

- Labour shortages: Labour remains one of the most challenging aspects of the foodservice industry, although it is reportedly less difficult today than it was in the past number of years.

Maureen Gahan, Foodservice Specialist at Bord Bia, said: “Last year’s major upswing in market growth was a welcome boost to the industry, and it is very positive that the value of the foodservice market this year has exceeded 2019 levels. However, the impact of inflation and increased cost of living in general is visible. Although Irish consumers are more pessimistic when looking ahead than other countries surveyed, we have identified key factors motivating consumers when eating out of home that we believe will help those working in the industry to navigate the future.”

“It was reassuring to find that good quality food is still the primary driver motivating consumers when eating out of home. Our key message to the Irish food and drink companies supplying the sector is to continue to maintain consistency and quality, while also being cognisant that delivering value is more critical than ever before. At the same time, we also know that value shouldn’t focus solely on price. Consumers are looking for premium experiences and those suppliers who can offer products or solutions that enhance the overall eating out experience are well positioned” she added.

Bord Bia Foodservice Supports

Bord Bia provides a range of ongoing supports to the Irish foodservice industry including market updates and insights, networking and collaboration opportunities and an annual Foodservice Directory containing over 100 detailed profiles of foodservice operators and distributors.