Unilever Shows Resilience

Unilever has reported a 0.1% decline in overall underlying sales to Eur25.7 billion for the first half of 2020, with developed markets up 2.4% and emerging markets down 1.9%. Group turnover decreased by 1.6% including a positive impact of 1.1% from acquisitions net of disposals and negative impact of 2.5% from currency.

During the second quarter, Unilever completed the acquisitions of the health food drinks portfolio of GlaxoSmithKline in India, Bangladesh and 20 other predominantly Asian markets. Acquiring the iconic brands Horlicks and Boost is in line with Unilever’s strategy to enhance its presence in healthy nutrition. Unilever also plans to unify its legal structure under a single parent company.

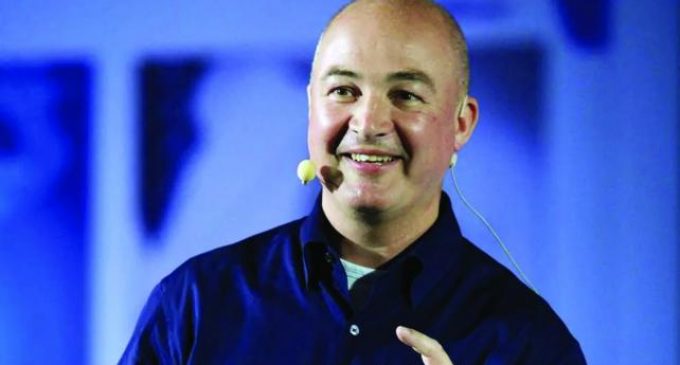

Alan Jope (pictured), chief executive of Unilever, comments: “Performance during the first half has shown the true strength of Unilever. We have demonstrated the resilience of the business – in our portfolio, in a continued step-up in operational excellence, and in our financial position – and we have unlocked new levels of agility in responding to unprecedented fluctuations in demand.

“We have also taken action to strengthen the strategic future of the company by announcing proposals to unify our dual-headed legal structure, progressing the strategic review of our global tea business and making new commitments to help protect the climate and regenerate nature.”

Strategic review of tea

In January, Unilever announced a strategic review of its global tea business, which includes leading brands such as Lipton, Brooke Bond and PG Tips. This review has assessed a full range of options. Unilever will retain the tea businesses in India and Indonesia, and the partnership interests in the ready-to-drink tea joint ventures.

The balance of Unilever’s tea brands and geographies and all tea estates, which generated revenues of €2 billion in 2019, will now be integrated into a separate entity. The separation process is expected to conclude by the end of 2021.

The balance of Unilever’s tea brands and geographies and all tea estates, which generated revenues of €2 billion in 2019, will now be integrated into a separate entity. The separation process is expected to conclude by the end of 2021.

Alan Jope continues: “From the start of the Covid-19 crisis, we have been guided by clear priorities in line with our multi-stakeholder business model to protect our people, safeguard supply, respond to new patterns of consumer demand, preserve cash and support our communities. Our focus for the rest of 2020 will continue to be volume led competitive growth, absolute profit and cash delivery, as this is the best way to maximise shareholder value.”

Foods & Refreshment

Unilever’s Foods & Refreshment business saw underlying sales decline by 1.7% to Eur9.8 billion in the first half, with volumes down 2.5% and positive pricing of 0.8%.

Lockdowns in most markets led to the closure of out-of-home channels. This, together with reduced tourism, led to a reduction in out-of-home ice cream sales of nearly 30%. Similarly, food service sales were down around 40% as hotels, restaurants, cafes and bars closed. At the same time, Unilever saw double digit growth in its retail foods business with Knorr and Hellmann’s performing strongly.

Sales of ice cream for consumption in-home increased by 15% in the first half and by 26% in the second quarter, significantly offsetting the declines in out-of-home channels. Magnum and Ben and Jerry’s continued to grow strongly.