UCD School of Agriculture & Food Science: Irish agri-food sector 5th in EU in terms of innovation

Ireland has the 5th most innovative agri-food sector in the European Union behind Denmark, Finland, Germany and the Netherlands, according to a new report published by University College Dublin and sponsored by Bank of Ireland today (11 June 2014).

It also shows that the sector is strong in terms of research capacity, overall education levels, and favourable tax regimes to encourage business innovation.

The report entitled “Innovation in the Irish Agrifood Sector” was compiled by researchers from University College Dublin following interviews with stakeholders from across the sector, and an analysis of data from Eurostat, the OECD, and the Teagasc National Farm Survey.

Pictured at the launch of the Innovation in the Irish Agrifood Sector report were Prof. Alex Evans, Dean UCD School of Agriculture and Food Science, Mr. Simon Coveney, Minister for Agriculture, Food and the Marine, Mr. Sean Farrell, ASA President and Alan Renwick, professor of agricultural and food economics, UCD School of Agriculture and Food Science

“It is very encouraging to see that Ireland ranks fifth in terms of innovation in the agrifood sector in the EU, according to this comprehensive report compiled by University College Dublin” said the Minister for Agriculture, Marine and Food, Simon Coveney TD at the launch of the report findings at a conference in University College Dublin.

“But the real value of this report is that it has identified several key areas where barriers to innovation in the sector exist. Barriers we can work to target and gradually lift in order to further support the sector towards becoming more innovative,” he said.

[quote]“Our universities, third-level institutes and the agri-food sector must work more closely together to build more applicable knowledge that can help further develop and grow the sector and, in turn, our economy,” added the Minister.[/quote]

“Ireland has a number of truly world class innovative companies, but at present there are too few newly emerging companies that will develop into world leading companies,” said Professor Alan Renwick, UCD School of Agriculture and Food Science, University College Dublin, the lead author of the report.

“There is a high level of government support for the agrifood sector and for science and technology within agriculture and food sectors in particular, but much of the science and the efforts at encouraging innovation are supply pushed rather than demand pulled,” he said.

“Even when companies are looking to engage with universities, and despite the considerable activity that is going on at high level within the University sector, they are finding it difficult to access the knowledge they require.”

“We need to refocus our efforts towards lifting the barriers identified in this report,” he concluded.

Seán Farrell, Head of Agriculture, Bank of Ireland Business Banking said, “We are proud of our position as the leading bank to the agri-sector, which straddles the entire value chain from farmer to processer including Ireland’s largest agri-food corporate companies. We see exciting investment opportunities for this sector and have the capital, capability and commitment to support this important sector.

[quote]“Innovation is at the core of successful industry, none more so than in the agri-food sector. Given Bank of Ireland’s very significant and market leading position within the agriculture industry in Ireland and our appetite to support such innovation, we were delighted to have the opportunity to partner with UCD’s School of Agriculture and Food Science in this study and the production of this insightful report on the Innovation system in Irish Agriculture” he added.[/quote]

The conference at University College Dublin was sponsored by the Irish Farmers Journal, Grant Thornton, Enterprise Ireland and Bank of Ireland.

Key recommendations from the report:

- Whilst recognizing that tax incentives already exist for all businesses, there is a need to consider greater incentives for (medium to large-sized) agrifood companies to engage more with R&D activity and in particular activities with a longer term horizon. This can be justified on the basis that agrifood businesses have been shown to contribute more to net export earnings than many other types of businesses.

- In terms of driving innovation, Universities need to further strengthen engagement with industry. This could involve the wider adoption of advisory boards comprising (but not exclusively) business representatives at the relevant levels within Universities. There is also a need for a more strategic approach to engagement. In addition reward structures (pay and promotion criteria etc.) within the University sector need to reviewed so as to put a greater weight on successful engagement with industry. This coupled with 1) above would mean that not only are companies incentivised to take a longer term view to R&D (fitting more with the timeframes of University research), but that academics are encouraged to look out to industry more which could improve accessibility for companies.

- The connections between industry-academia should also be focused on development of new products that add value to the existing commodities produced in Ireland. It also needs to be in a form that is accessible to new and emerging small scale enterprises.

- Alternative funding arrangements (such as the establishment of agrifood venture capital funds)[1] are needed to overcome the identified financial constraints through the agrifood chain. Due to risk and return issues this may need to involve the development of novel public/private funding partnerships. These alternatives may be attractive to those that are averse to debt but require access to funding for expansion.

- There is a need to rethink our education and advisory structures to ensure they are fit for purpose in driving innovation through the agrifood chain.

a. In terms of education this could involve initiatives such as promoting greater cross fertilization between courses. For example, combining business and enterprise with science skills or a realigning of the agricultural colleges to create centres of excellence in particular aspects of agriculture (dairy, beef, tillage/horticulture).

b. In terms of advisory services this requires a move away from a system driven by the bureaucratic requirements of the Common Agricultural Policy to one driving innovation. Further development of the models being discussed for public/private collaboration in service delivery will benefit this. - Industry forums, facilitated by the Government, in which all players in the supply chain can undertake full and frank discussions in the spirit of openness, can begin to create transparency which in turn can lead to trust and a stronger incentive for collaboration. In the beef sector for example, this could build on the forum that has been established as a result of the current difficulties in the sector.

- Every effort needs to be continued to be made to encourage structural change within the agricultural sector to facilitate innovation and profitability. Further consideration needs to be given as to how CAP support funding can be used to drive innovation. Whilst recognizing the constraints of the current system, in the future there should be a greater linkage between payments and uptake of new technologies or practices (such as improved genetics, animal health planning etc.). More widely, it will be important to ensure that there is effective implementation of European Innovation Partnerships within Ireland.

- Overall, there is a need for key sections within the agrifood innovation system to engage in full and frank internal debate as to whether their structures are fit for purpose for an Irish agrifood sector that wants to be world leading in terms of innovation and performance. Leadership is needed in this area to ensure that innovation is facilitated and not hindered within Ireland.

[box type=”note”]Notes:[/box]

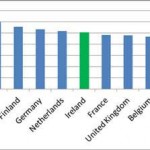

Index of Innovation for the Overall Agrifood Sector

A series of indicators were used to highlight how the Irish Agrifood sector is performing in terms of innovation in an international context. The indicators were drawn from available data and can be categorized into:

· Innovation inputs (e.g. private and public investment in R&D)

· Innovation outputs (e.g. patents, publications)

· Innovation outcomes (firm and farm performance)

Based on these indicators, an index of innovation is calculated in order to compare Ireland’s performance internationally. As Figure E1 highlights, Ireland has the 5th most innovative agrifood sector in the EU according to this index, lying behind Denmark, Finland, Germany and the Netherlands. Though it should be noted that the overall score for the Netherlands and Ireland were very similar indicating that, to all intents and purposes, they were equal in terms of this index.

[1] For clarification it should be noted that this does not necessarily mean a call for more venture capitalists in the agrifood sector.