“This is a big work stream for us in how we present our information.”

Constellation Brands says it is introducing a Bloody Mary-style beer in the US as it seeks to exploit a ‘pretty large category’ currently dominated by one player.

The US-based wine, beer and spirits business announced Q1 2014 net sales of $673m yesterday, up 6% year-on-year on a comparable basis.

But Q1 net income fell 3% to $74m, with Constellation blaming higher grape costs and Selling, General and Administrative Expenses (SG&A) expenses.

$4.75bn beer buy adds ‘entirely new dimension’

During an investor call to discuss the firm’s results, Lauren Torres from HSBC asked CEO Robert Sands what could be “done differently in beer” now it had full ownership of Anheurser-Busch InBev’s (AB InBev’s) US beer business.

Constellation completed its acquisition of Grupo Modelo’s US beer business from AB InBev on June 7 2013 for $4.75bn.

The deal includes AB InBev’s large-scale brewery in New Mexico (lending it dedicated beer production facilities for the first time), full ownership (the other 50%) of the import business for brands including Corona, Crown Holdings, and a permanent license to sell these brands in the US.

Sands said the acquisition had added “an entirely new dimension to our company”, and told analysts that Constellation was most excited about opportunities for innovation and NPD in beer.

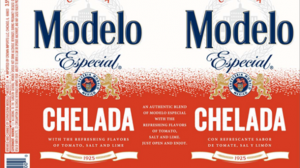

The company had already introduced and was test marketing Modelo Especial Lite in the US, he said, adding that itplans to introduce Modelo Especial Chelado, a Bloody Mary-style beer, in the US.