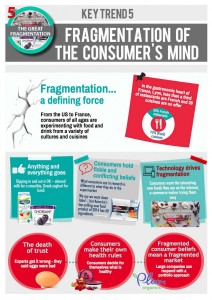

The Great Fragmentation of health drives growth for small and niche brands

The massive fragmentation of consumers’ beliefs about health is contributing to the break-up of traditional food and beverage markets and opening the doors of opportunity for start-ups and small brands, says Julian Mellentin, director of New Nutrition Business and author of 10 Key Trends in Food, Nutrition and Health 2016.

“Big food companies are being forced to rethink their business models,” he says.

Key Trend 5: The Great Fragmentation explains how high volume opportunities are scarce and becoming scarcer. “In some markets they may already be history”, says Mellentin.

The shift in the food landscape is influenced by 25 years of digital sampling, mash-ups, music sampling, remixing, restaurant fusion food – all an established part of the culture that surrounds people.

Just as the person who listens to Bach’s Goldberg Variations at home also listens to Aerosmith or Black Sabbath while driving to work, people’s ideas about food and health have become a menu of choices from which they select and change as new information becomes available. We’re all food explorers now, looking for novelty and variety.

This is producing a proliferation of niches that smaller companies and new brands – often premium – are perfectly placed to serve.

In the future, smart companies will only rarely launch mass-market brands aiming to rapidly get high volume. Instead they will build portfolios of small brands, finely targeted at an ever-more fragmented consumer market. A few of these will become big brands, some will be big niche, most will remain niche.

The report gives the example of US giant General Mills as one of the few larger and more visionary companies already embracing the change. It has set up a new business unit – called 301 Inc. – to invest in entrepreneurs and early stage food companies.

“The rapidly evolving consumer landscape is dramatically changing the game in the food industry,” said John Haugen, general manager of 301 Inc. “Tremendous opportunity exists…to partner with and foster emerging food brands.”

“The rapidly evolving consumer landscape is dramatically changing the game in the food industry,” said John Haugen, general manager of 301 Inc. “Tremendous opportunity exists…to partner with and foster emerging food brands.”

As the Great Fragmentation moves forward, this new model will become the standard for large food and beverage businesses. The market-redefining power of this trend is illustrated by Key Trend 7: Plant-Based Foods and Beverages. Non-dairy plant “milks” such as almond milk have seen sales jump by between 20% (Spain) and 50% (US).

This trend is not driven by beliefs in veganism or vegetarianism, but rather by consumers’ love of variety and novelty. We’re all flexitarians now, using cows’ milk on our cereal, almond milk in our smoothies and coconut milk in our cooking as it suits us. And the halo of health and sustainability around plant-based foods means consumers feel good about their choices.

This trend has also been made possible by massive improvements in the taste of plant-based foods (which accounts for almond milk’s rise at the expense of soy milk), and by technical advances that make it easier to include plant-based ingredients such as beans and seaweed in good-tasting snack formats.

Fragmentation also underpins Key Trend 1: Beverages Redefined. Beverage giants’ sales have peaked, soft drink sales are plunging and fruit juices are struggling. Small niche drink brands are reshaping the market. Plant waters such as coconut and birch water meet consumers’ desire for products that are naturally healthy, have no additives, are naturally low in calories and sugar, and sustainable. “Plant waters will be a $4 billion market by 2025,”