The Global Coffee Capsules Market

A new report from industry consultants, AMI Consulting in cooperation with Plastic Technologies Inc., published in August 2016, is an authoritative comprehensive deep-dive analysis of the global Single Serve Beverage Capsules industry (aka coffee capsules).

No longer a niche market, the capsules industry has developed into a complex value chain over the years. Back in mid to late 1990s, the segment was a classic market example of an oligopoly, only limited to the pioneers of this segment: Nestlé (with Nespresso) and Keurig Green Mountain (with K-Cups). At that time, there were also a couple of Italy-centred systems for traditional espresso brewing (e.g. Lavazza Espresso Point).

Relatively recently (2000s), as the capsules format became more popularised, brands such as Dolce Gusto (by Nestlé), Tassimo (by Kraft, now Jacobs Douwe Egberts) and A Modo Mio (by Lavazza) found their successful, high margin niches on the market.

Relatively recently (2000s), as the capsules format became more popularised, brands such as Dolce Gusto (by Nestlé), Tassimo (by Kraft, now Jacobs Douwe Egberts) and A Modo Mio (by Lavazza) found their successful, high margin niches on the market.

The year 2012 marked the beginning of a dramatic market transformation, driven by the change of legal circumstances. The expiry of Nespresso and Keurig design patents in 2012 brought about disruptive changes in the supply chain, creating new opportunities for both end-users and converters to tap into this growing market segment. Albeit with some legal battles, these circumstances triggered the development of Nespresso-compatible brands and own label products that could now rely on the Nespresso machines instalment base, but offer a more competitive retail price for the capsules. Barriers to enter the capsules segment became lower (both from filling and moulding perspective).

On the other hand, the supply chain of capsules is rapidly losing its oligopolistic nature and the former dominance of major suppliers has been challenged as the market is expanding. A more fragmented supply chain affects the overall profit pool and the way consumers make their choices.Needless to say, that transformation had an adverse effect on the premium image of the segment: the average price was lowered and the quality of some capsules available on the market poorer (based on OTR and performance in brewing machines). The potential machine malfunction (or misuse) in correlation with compatibles introduced some operational challenges for Nestlé and its machine partners to do with machine servicing (i.e. increased service costs).

On the other hand, the supply chain of capsules is rapidly losing its oligopolistic nature and the former dominance of major suppliers has been challenged as the market is expanding. A more fragmented supply chain affects the overall profit pool and the way consumers make their choices.Needless to say, that transformation had an adverse effect on the premium image of the segment: the average price was lowered and the quality of some capsules available on the market poorer (based on OTR and performance in brewing machines). The potential machine malfunction (or misuse) in correlation with compatibles introduced some operational challenges for Nestlé and its machine partners to do with machine servicing (i.e. increased service costs).

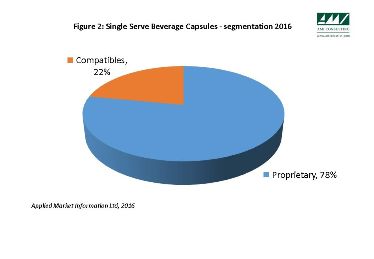

AMI Consulting estimates that all plastic compatible capsules (across all systems) account for 22% of the Single Serve Beverage Capsules market worldwide by unit volume. The Nespresso system is world’s biggest selling system with volume of ca.17 billion units – that includes both Aluminium capsules and plastic Nespresso compatibles.

Interestingly, the North American market has not experienced an influx of Keurig imitations post-2012 to the extent comparable to Nespresso’s fate.

The development of new compatible offering is now in favour of the Nescafé Dolce Gusto system (another brand of Nestlé). The market penetration of Dolce Gusto compatibles is still low at the moment, but it is expected to grow strongly in the coming years.