Noble Foods and Cranswick Recognised as Global Leaders on Farm Animal Welfare

The seventh annual Business Benchmark on Farm Animal Welfare, supported by Compassion in World Farming and World Animal Protection, has confirmed Cranswick, Noble Foods, Marks & Spencer, Waitrose and Co-op Group (Switzerland), as global leaders on farm animal welfare. However, while many of the 150 companies covered by the Benchmark have now adopted farm animal welfare policies and implemented farm animal management systems, the majority provide limited or no information on their farm animal welfare performance.

Commenting on the overall findings, Nicky Amos, Executive Director of BBFAW, notes: “Company practice continues to show consistent year on year improvement. For example, 53% of companies now have explicit board or senior management oversight of farm animal welfare and 71% have published formal improvement objectives for farm animal welfare. However, these encouraging findings on management processes are not matched by performance; for example, while just over half of companies report on the proportion of animals that are free from close confinement, only one in four companies covered by the Benchmark provides any information on the proportion of animals that are stunned prior to slaughter and only one in five companies reports on live animal transport times.”

The 2018 Report demonstrates that UK companies achieved a significantly higher overall average score (61%), compared to companies from other geographic areas, including North America (28%) and Europe, excluding the UK, (34%).

Philip Lymbery, CEO of Compassion in World Farming, comments: “This position, however, could be undermined by Brexit if existing welfare legislation is not retained in the UK. Conversely, Brexit could be an opportunity for the UK to get even further ahead if the government were to make its own animal welfare legislation, for example, by introducing a ban on caged egg production (as is the case in Germany) and banning live exports for fattening and slaughter.”

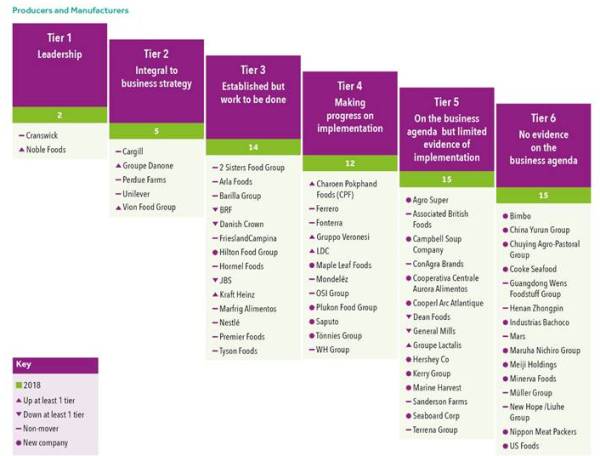

Of the 150 companies (up from 110 last year) assessed, 63 were in the Producers & Manufacturers sector, including the top 40 global producers (which represent the top 10 poultry producers) with annual revenues of over US$4.6 billion. There were 23 new producers/manufacturers in the 2018 Benchmark with Campbell Soup Company, Hilton Food Group, Kerry Group and Hershey Co amongst them. Overall, in the Producers & Manufacturers sector, eight companies moved up one tier, five fell by one tier, and 27 companies were non-movers.

Traditionally, the Producers & Manufacturers sector and the Retailers & Wholesalers sector have both outperformed the Restaurants & Bars sector (a category that includes many of the food service providers). However, in 2017, the performance gap closed between them and has continued to do so this year with the average scores for the Retailers & Wholesalers sector and the Restaurants & Bars sector both being 32%. The average score for the Producers & Manufacturers sector lags slightly at 31%.

The Producers & Manufacturers sector saw the highest number of new companies being assessed by the BBFAW this year, with many new entrants appearing in the lowest two tiers. Despite this, two producers appeared in the top Tier again this year – Noble Foods, which had briefly dropped to Tier 2 in 2017, and Cranswick which has retained its top polling position.

Two factors contributed to Noble Foods reclaiming its Tier 1 position this year. First, the company has improved its performance reporting and welfare impacts for laying hens and dairy cows (used in the company’s Gü desserts), and for its position on the responsible use of antimicrobial medicine. Noble Foods does not permit the routine prophylactic use of antimicrobials, but acknowledges that controlled intervention may be required on a clinically assessed risk basis to prevent the outbreak and spread of disease and to safeguard animal welfare. Noble Foods requires its farmers’ medicine records to provide an annual record of the amount of antibiotics used, and for each farmers’ use of antibiotics to be reviewed annually by a vet.

Two factors contributed to Noble Foods reclaiming its Tier 1 position this year. First, the company has improved its performance reporting and welfare impacts for laying hens and dairy cows (used in the company’s Gü desserts), and for its position on the responsible use of antimicrobial medicine. Noble Foods does not permit the routine prophylactic use of antimicrobials, but acknowledges that controlled intervention may be required on a clinically assessed risk basis to prevent the outbreak and spread of disease and to safeguard animal welfare. Noble Foods requires its farmers’ medicine records to provide an annual record of the amount of antibiotics used, and for each farmers’ use of antibiotics to be reviewed annually by a vet.

Kraft Heinz’s promotion to Tier 3 from Tier 5 should be noted. This progress can largely be attributed to the company publishing updated animal welfare policies, and more detailed reporting on the company’s management controls and improvement targets, and its animal welfare performance in its 2017 Corporate Social Responsibility report.

Globally, Kraft Heinz is switching to using only cage-free eggs across all its operations by 2025 and in Europe, its goal is to achieve 100 percent free range by 2020. The company has also committed to source all its pork globally from suppliers that do not use sow stalls. Since 2017, Kraft Heinz has been giving preference to suppliers that are able to help it achieve its goal of being 100% sow stall free. The company also supports industry initiatives that will eliminate cow tail docking in its milk supply chain, and it is committed to improving the welfare of broiler chickens by working with its suppliers and the industry to meet even higher welfare standards by 2024.

Caroline Krajewski, Head of Global Corporate Social Responsibility for Kraft Heinz, says: “Treating animals with care, understanding and respect is fundamental to our animal welfare agenda, which is why we’ve set clear positions with transparent reporting mechanisms to track our progress. We know responsible sourcing is important to our stakeholders – and it’s important to us – so you’ll continue to see more from Kraft Heinz as we grow in this area.”

Other producers or manufacturers to successfully move up a tier are Groupe Danone and Vion Food Group, both of which moved to Tier 2. Unilever, Perdue Farms and Cargill remained in Tier 2, while 2 Sisters Food Group, Nestlé and Premier Foods remained in Tier 3. Companies dropping a tier were BRF, JBS and Danish Crown (from Tier 2 to Tier 3) and Dean Foods and General Mills (from Tier 4 to Tier 5).

The Benchmark undoubtedly provides a solid framework for companies on which to build and improve their performance and it is driving change. The overall average score at 32% is down from 37% in 2017, but this is not unexpected with the introduction of 43 new companies and the increased weighting (from 24% in 2017 to 35% of the total score in 2018) of the performance reporting and impact questions in the 2018 Benchmark. If we were to exclude the scores for the new companies and the increase in weighting, then the overall average scores would have been 38% and 41% respectively. Notwithstanding the like-for-like improvements in scoring, it is clear that there is much work to be done before the food industry is effectively managing the business risks and opportunities associated with farm animal welfare.

Dr Rory Sullivan, Expert Advisor to the BBFAW, says: “Investors need to have confidence that companies are delivering the outcomes that they aspire to, in terms of improved farm animal welfare and in terms of better business risk management. The Benchmark exposes the gap between policies and performance, highlighting those companies whose governance processes work effectively and those that are not fit for purpose in a world where farm animal welfare is an increasingly important driver of business value.”

Philip Lymbery, CEO at Compassion in World Farming, adds: “The Benchmark and the investors supporting it have played a key role in keeping farm animal welfare firmly on the corporate agenda. As this year’s report shows, we need to ensure that this attention delivers real and concrete benefits for animals farmed for food.”

The Benchmark is a long-term change initiative which is showing signs of progress. Of the 55 food companies that have been continuously benchmarked since 2012, 17 (31%) have moved up one Tier, 20 (36%) have moved up two Tiers and 8 (15%) have moved up three Tiers. Furthermore, the average score for these trend companies has improved from 25% in 2012 to 48% in 2018. These improvements are even more striking given the tightening of the Benchmark criteria over time and these companies should be congratulated. Their success demonstrates that BBFAW is driving higher farm animal welfare standards across the world’s leading food businesses and while there is still much work to be done, there is both an appetite and a willingness for change.