Ice Cream Whips Up Global Sales of 13 Billion Litres in 2016

New research from Mintel reveals that the global ice cream market is expected to scoop sales of 13 billion litres in 2016, with India, Indonesia and Vietnam among the world’s fastest growing markets. While India’s ice cream market has experienced a Compound Annual Growth Rate (CAGR) of 13% over the past five years, in 2017, volume sales in India are set to overtake those of more established markets, including the UK. Ice cream sales in India are forecast to reach 381.8 million litres in 2017, with the market forecast to reach 657.2 million litres in 2021.

India’s strong CAGR is closely followed by Indonesia (11%), Vietnam (9%), Turkey (9%) and Malaysia (8%). On the other hand, sales of ice cream in other markets are flakey. Volume sales of ice cream in Switzerland have had a CAGR of -3% over the past five years, followed by Thailand (-2%), Denmark (-2%), the UK (-2%) and the US (-1%).

China is currently the world’s biggest ice cream market, with sales estimated at 4.3 billion litres in 2016, followed by the US (2.7 billion litres) and Japan (756 million litres). However, in terms of individual ice cream consumption, Mintel research finds that Norwegian consumers are the biggest ice cream eaters, consuming 9.8 litres per capita in 2016, followed by Australia (9.4) and Sweden (8.9).

Alex Beckett, Global Food and Drink Analyst at Mintel, comments: “Food historians credit China with inventing ice cream and Marco Polo for introducing it to Italy on his return from the Far East. Skip forward to the 21st century, and the rate at which Western ice cream makers are looking to the East for inspiration promises to see renewed momentum. The rapidity with which India’s ice cream market is expanding is worth noting. The low per capita consumption of retail ice cream in India demonstrates the exciting potential in what is the world’s second most populated country, although competition from street vendors should not be underestimated.”

Alex Beckett, Global Food and Drink Analyst at Mintel, comments: “Food historians credit China with inventing ice cream and Marco Polo for introducing it to Italy on his return from the Far East. Skip forward to the 21st century, and the rate at which Western ice cream makers are looking to the East for inspiration promises to see renewed momentum. The rapidity with which India’s ice cream market is expanding is worth noting. The low per capita consumption of retail ice cream in India demonstrates the exciting potential in what is the world’s second most populated country, although competition from street vendors should not be underestimated.”

Indeed, with the East’s love of ice cream thickening, one in three (32%) ice cream products were launched in Asia Pacific in 2016, up from 26% in 2013. What’s more, the share of ice cream products launched in North America fell from 19% to 14% in the same time period.

Innovation

Clearly keen to get a scoop of the product innovation action, Western consumers are increasingly looking to try ice cream products with more Eastern inspired flavours. Over a quarter (30%) of Canadians would be interested in ethnically-inspired ice cream flavours, such as green tea or mango, while 23% would be interested in internationally inspired ice cream formats, such as Japanese mochi ice cream or Indian kulfi.

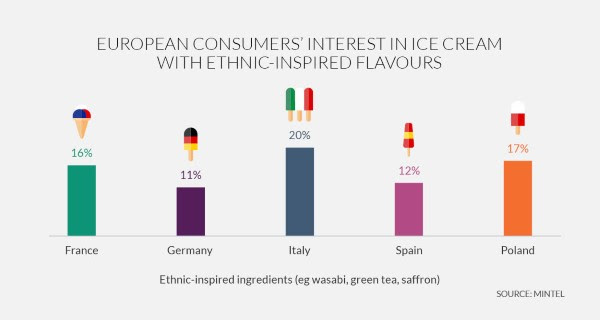

In Europe too, ice cream eaters are acquiring a taste for the exotic. As many as 20% of Italian, 17% of Polish and 16% of French consumers would be interested in trying ice cream with ethnic-inspired ingredients, such as wasabi, green tea or saffron.

“In the US, mochi ice cream, the Japanese treat of frozen rice dough around an ice cream filling, is set to continue growing in profile in 2017. Meanwhile, Thai-style rolled ice cream also continues to gain food press headlines in North America, often pitched as the next big thing in desserts. The Middle East also promises to become more influential for ice cream innovation. In particular, booza, a traditional type of ice cream from Syria and Lebanon, has one clear advantage which should resonate the world over: it is very slow to melt,” Alex Beckett adds.

“In the US, mochi ice cream, the Japanese treat of frozen rice dough around an ice cream filling, is set to continue growing in profile in 2017. Meanwhile, Thai-style rolled ice cream also continues to gain food press headlines in North America, often pitched as the next big thing in desserts. The Middle East also promises to become more influential for ice cream innovation. In particular, booza, a traditional type of ice cream from Syria and Lebanon, has one clear advantage which should resonate the world over: it is very slow to melt,” Alex Beckett adds.

Growing Appetite For Vegan Ice Cream

Finally, Mintel research shows that ice cream aisles throughout the world have been experiencing a dairy-free makeover. The share of global dessert and ice cream launches featuring a vegan claim has increased from 2% in 2014 to 3% in 2015 and 4% in 2016, with Europe accounting for 59% of all launches in 2016.

The rise in innovation comes as many consumers are looking to cut down on their dairy consumption. As many as three in 10 (29%) Italians say they are actively reducing their consumption or are avoiding dairy, followed by a quarter (23%) of French consumers, 16% of Polish consumers and 14% of Germans.

Germany, meanwhile, is a hotbed of non-dairy ice cream innovation, and accounted for 19% of global vegan dessert and ice cream launches in 2016 – more than any other country. This reflects Mintel research that 63% of German ice cream consumers express an interest in non-dairy versions.

“Consumers’ aspirations to live healthier and ‘cleaner’ lifestyles are motivating them to increasingly prioritize fruits, vegetables, nuts, grains, spices and botanicals. Consequently, plant ingredients and vegan claims are becoming more prominent in a variety of food categories – including ice cream,” Alex Beckett concludes.